Avoid My Top 7 Money Mistakes as an African Immigrant in Germany

Introduction

Managing money in a new country can be hard. You deal with language barriers, new rules, and daily stress. Many immigrants wait too long to learn how money really works in Germany. The scary part? Small mistakes today can become huge problems later.

People in Germany are now living much longer. Today, there are already about 600,000 people living over the age of 100. That means retirement will cost more than ever, and you must plan early.

Here are the top money mistakes I learned the hard way. Please avoid them.

1. Waiting Too Long to Save

Most people think they can start later. But time is the real investment.

One friend told me:

“I was shocked how fast the years passed. Now I’m trying to catch up.”

Start small. Start early. Even €50 a month grows.

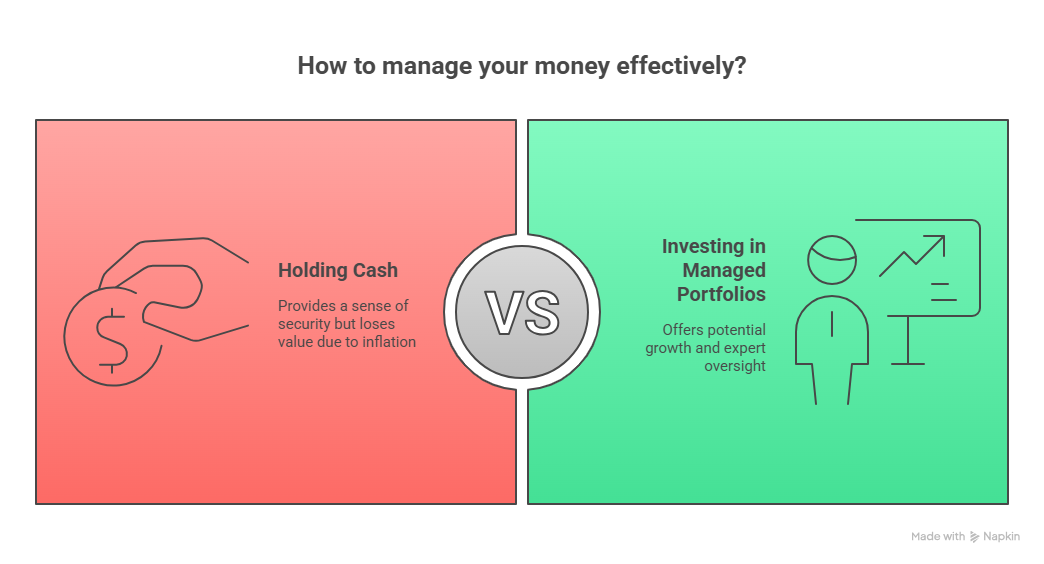

2. Keeping Too Much Cash

You might feel safe holding cash. But inflation eats your money slowly. Savings accounts pay little, and the cost of living keeps rising.

Professionally managed portfolios can help you grow your money without watching the market every day. Experts check the performance and quality for you.

Think of it like planting seeds instead of holding seeds in your hand.

3. Not Having an Emergency Fund

Life can change fast in Germany:

job loss,

visa delays,

family support needs,

rising rent.

A simple emergency fund can save you from stress.

Flexible contribution options allow you to pause or reduce payments when money gets tight.

One person told me:

“When my job contract ended, I was glad my plan could pause.”

Smart and safe.

4. Ignoring Retirement Planning

Many immigrants believe they will not retire in Germany. But plans change.

With a fondsgebundene Rentenversicherung, you can choose:

You can even switch to better payout options later thanks to the Innovationsklausel

That means you stay future-proof.

5. Taking Too Much Risk

When markets drop, beginners panic. You might want more safety later in life — and that’s fine.

With the Sicherungsoption, you can move parts of your investment into safer places without tax issues

6. Overspending Instead of Earning Cashback

People think they must spend more to save more. Not true.

With the plusrente system, you get cashback from everyday shopping at more than 1,200 stores. That cashback adds to your retirement savings and grows over time.

One woman laughed:

“Buying school shoes added money to my pension!”

Free money is good money.

7. Not Adjusting When Life Gets Hard

Money is emotional. When life gets tough, many people cancel everything — and lose long-term benefits.

Instead, you can:

The product sheet clearly shows flexible options for kurzfristige Zahlungsschwierigkeiten like contribution pauses, stunting, and reductions.

You don’t have to break your plan. You just bend it.

Bonus Tip: Don’t Try To Do Everything Alone

Germany is full of rules. Get help. Ask questions. Talk to advisors who understand your situation and culture.

So, What Should You Do Now?

Avoiding these money mistakes comes down to:

✅ Start early

✅ Grow money in funds

✅ Protect yourself from stress

✅ Adjust risk over time

✅ Use cashback to save more

✅ Stay flexible when life changes

You do not need to be rich to begin. You need:

time,

consistency,

guidance.

Your older self will thank you.

🎁 Want to Avoid These Mistakes in 10 Minutes?

Grab my free 4-Step Money Mistake Prevention Checklist.

It helps you: