€200 a Month for 6 Years: What africans in germany Can build With smart saving

Introduction

What if you save €200 every month for 6 years?

Honestly… it’s a bigger deal than most people think.

A lot of Africans living in Germany are working hard, supporting family, paying bills, and still trying to build something for the future.

So the real question is:

Can small monthly investing actually lead to real wealth?

Yes. And the numbers are clearer than you might expect.

Why This Matters (Especially in Germany)

Living in Germany gives you structure.

You have access to banks, investment platforms, and long-term financial tools.

But many people still feel like investing is only for the rich.

“I used to think investing was for people with thousands of euros already. Then I realized consistency matters more than size.”

That’s why €200 a month is such a powerful example.

The Real Numbers: €200/Month for 6 Years

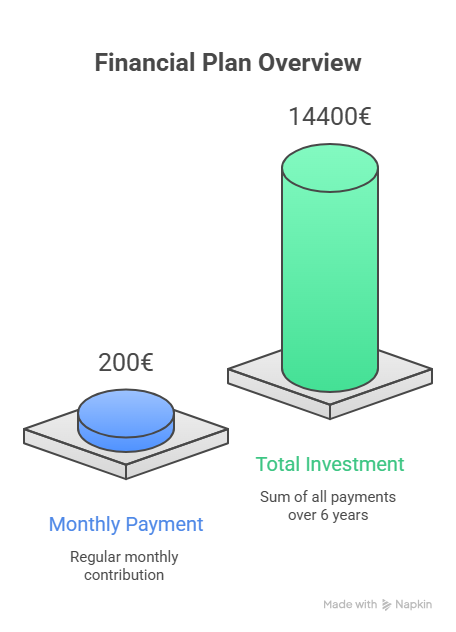

Let’s keep it simple.

Your plan:

- €200 every month

- For 6 years (72 months)

Total money you put in:

€200 × 72 = €14,400

Now here’s where investing changes everything.

Using a Real Portfolio Example (Not Guesswork)

We can use the Portfolio Offensiv factsheet as a reference.

This is a growth-focused portfolio designed for long-term investors.

It shows a 5-year annual return of 11.65% per year.

“That kind of return is what makes monthly investing grow faster than savings.”

It also comes with normal ups and downs because it is equity-based.

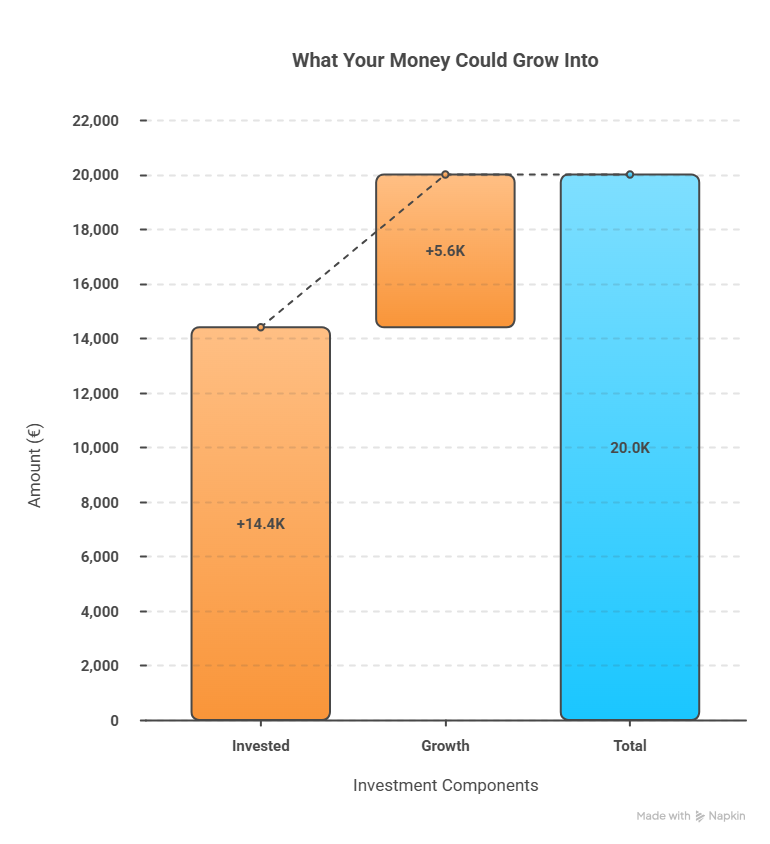

What Your Money Could Grow Into

If you invest €200/month with an average return around 11.65%, your account after 6 years could look like this:

- Total invested: €14,400

- Estimated value after 6 years: €20,000–€20,700

That means you could gain around €5,600+ just from growth.

“Most people think €200 is small… until they see what 6 years does.”

Savings vs Investing (Big Difference)

If you keep your money only in a savings account, growth is slow.

But investing in a diversified portfolio gives your money a chance to compound.

“It’s not about being rich. It’s about being consistent.”

That’s why monthly investing works so well.

A Quick Reality Check: Risk Is Normal

This portfolio is made of 100% equity funds, so it can drop temporarily.

The factsheet shows a maximum drawdown of about –17%.

That sounds scary at first.

But long-term investors expect this.

“Yes, it can dip. But long-term is where it shines.”

Fees Matter (But Don’t Stop You)

Portfolio Offensiv has an effective yearly cost of about 0.95%.

That’s normal for actively managed portfolios.

“Even after fees, the growth can still be worth it when you stay invested.”

Free Info session: How to start?

If you want to start investing in Germany but don’t know where to begin, grab the free info session with afrofin:

✅ The 4-Step Starter Plan

- What is my situation?

- What are the option in my situation?

- Can I use free money cashback system?

- Understand basic German tax allowances

Fill out the formular and lets have a look what we can do HERE

Conclusion: What This Can Do for Your Life

So, what happens if you invest €200 a month for 6 years?

You contribute €14,400.

And with long-term growth, it could realistically become around €20,000.

And here’s the part people don’t talk about enough:

“This money isn’t just savings. It’s options.”

You could use it to:

- help with a down payment for your own apartment in Germany

- move from renting to owning

- invest further into business or other opportunities

- or simply create financial peace of mind

“Some people use it to buy property. Others use it to build freedom. Either way, it becomes yours.”

Get in touch, join our community

The 4 Steps to Financial Freedom for Africans in Germany

Stop dealing with confusing finances. We have compiled the most common mistakes and the most crucial first steps into one super simple checklist.

Don't wait any longer for the perfect moment. The best time to take control of your finances is today. Start with our checklist, which gives you a clear plan immediately.

We will send you the checklist instantly and easily via WhatsApp.

🌱 Dein nächster Schritt

Viele Menschen glauben, nachhaltiges Investieren sei kompliziert. In Wahrheit brauchst du nur die richtigen Schritte – und genau die haben wir für dich zusammengestellt. Lade dir jetzt den kostenlosen 5-Schritte-Ratgeber für nachhaltiges Investment herunter und entdecke, wie dein Geld für dich und die Umwelt arbeiten kann.

© 2025