What Is the Meaning of Insurance Protection in Germany?

Introduction

Moving to Germany can feel exciting. But the financial system here can also feel heavy, confusing, and full of long words. One of the most important ideas to understand is insurance protection.

So what does it really mean?

In simple terms, insurance protection is a way to protect your money, your future, and your family when life surprises you. And as an African immigrant in Germany, those surprises can be even bigger because you are building life far from home.

People in Germany are now living longer than ever. Today, there are already about 600,000 people living over the age of 100. That means the cost of retirement is rising and you must protect your future income early:

Let’s break it down in a simple way.

1. Insurance Protection Means Guarding Against Big Losses

When something bad happens — a car crash, sickness, job loss — insurance protection helps you avoid going broke. It spreads risk across many people.

One friend told me:

“I thought insurance was a waste… until I needed it.”

Protection gives you peace of mind. You sleep better.

2. Consider a Flexible Retirement Insurance (Fondsgebundene Rentenversicherung)

This is a powerful beginner option.

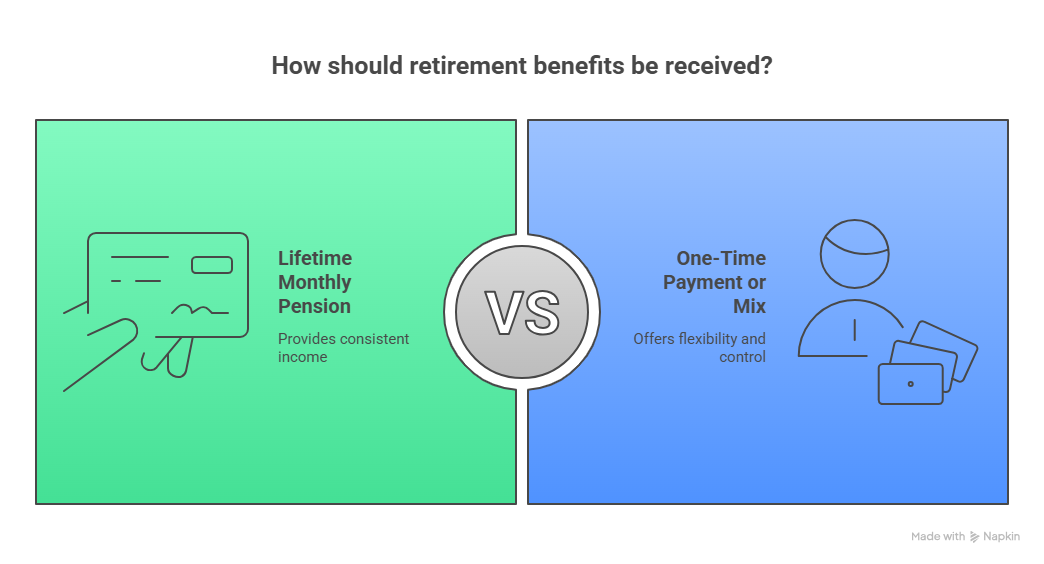

During the saving phase, your money is invested in the market. When retirement comes, you can choose:

a lifetime monthly pension

a one-time payout

or a mix of both

This flexibility matters when you don’t know what life will look like later.

If better retirement options appear in the future, you are covered by an “Innovationsklausel,” which means you can switch to improved payout types later.

That is huge.

A customer once said:

“I like knowing I can get monthly money if I stay in Germany, or take cash if I move home.”

Exactly.

3. Insurance Protection Means Adjusting Risk as Life Changes

Maybe today you want growth. But later you want safety for your family.

With the Sicherungsoption, you can shift part of your investment into a safer area when your risk tolerance changes. And you can do it without tax issues, which helps protect profits.

I once heard someone say:

“When my baby arrived, growth was cool… but safety felt better.”

Life changes. Your risk should too.

4. Insurance Protection Means Help During Hard Times

What if money gets tight because of:

visa delays?

job loss?

family support back home?

Many insurance products offer payment flexibility, so you can:

pause contributions,

reduce contributions,

avoid canceling everything

The product sheet lists options for kurzfristige Zahlungsschwierigkeiten, like contribution pauses, stunting, and reductions.

This protects your long-term plan when short-term life hits you hard.

5. Insurance Protection Means Security for Your Family

If something happens to you, insurance protection can help ensure your family does not suffer financially. Many plans include a Beitragsrückgewähr, which guarantees your contributions are returned at minimum.

That means:

less stress,

more dignity,

family protection.

6. Insurance Protection Means Professional Money Management

You do not have to “play the stock market.” Many plans offer professionally managed portfolios. Experts check performance, quality, and alignment with your goals.

They are “laufend geprüft und optimiert” — constantly monitored and improved for you. As one father put it:

“I don’t have time to be a full-time investor. Experts do the watching.”

That’s protection too — protecting you from your own mistakes.

So, What Does Insurance Protection Really Mean?

Here’s the clear answer:

✅ It protects you from losing big money

✅ It protects your retirement income

✅ It protects your family if something happens

✅ It protects you when life gets tough

✅ It protects you from making risky decisions

✅ It protects your growth over time

Think of it like an umbrella you hope you never need… but feel happy to have when the storm comes.

Want to Make Sure You Are Fully Protected?

I created a free 4-Step Protection Checklist to help you:

pick the right coverage,

avoid common mistakes,

adjust risk levels,

protect your family.

Get Your Checklist – Free via WhatsApp

The 4 Steps to Financial Freedom for Africans in Germany

Stop dealing with confusing finances. We have compiled the most common mistakes and the most crucial first steps into one super simple checklist.

Don't wait any longer for the perfect moment. The best time to take control of your finances is today. Start with our checklist, which gives you a clear plan immediately.

We will send you the checklist instantly and easily via WhatsApp.

🌱 Dein nächster Schritt

Viele Menschen glauben, nachhaltiges Investieren sei kompliziert. In Wahrheit brauchst du nur die richtigen Schritte – und genau die haben wir für dich zusammengestellt. Lade dir jetzt den kostenlosen 5-Schritte-Ratgeber für nachhaltiges Investment herunter und entdecke, wie dein Geld für dich und die Umwelt arbeiten kann.

© 2025