What Is Best to Invest in as a Beginner in Germany? A Simple Guide

Introduction

If you’re new to investing, you might be thinking, “I want to invest my money, but what’s the best way for a total begin

Starting to invest in Germany can feel confusing, especially when you are far from home. Many African immigrants worry about taxes, paperwork, and losing money. Others think you need a lot of cash to invest.

But the truth is simple: you can start small, grow over time, and protect yourself from risk.

People in Germany are now living longer than ever. In fact, there are already about 600,000 people over 100 years old living among us. That means we all need smart retirement planning early.

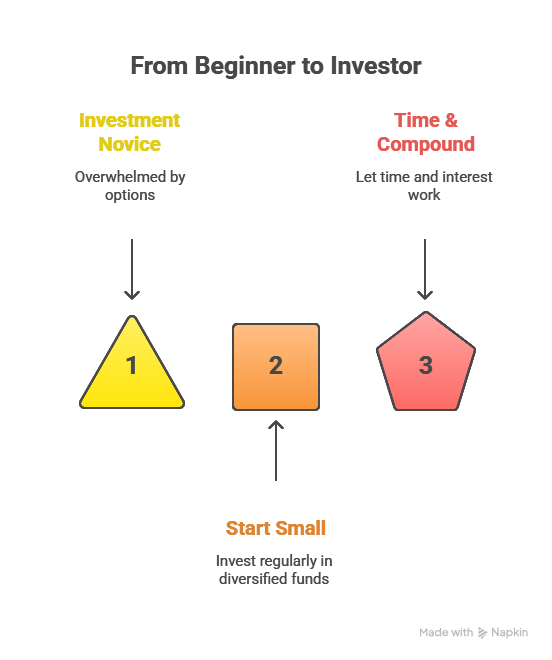

So what should beginners invest in?

Let’s break it down.

1. Start With Simple, Diversified Funds

New investors should avoid stock-picking. It is stressful and risky.

Instead, most beginners do better with funds. Funds collect many companies inside one basket. If one company falls, others help balance it.

You can build your own mix or choose professionally managed portfolios. These are watched and optimized by experts, so you don’t need to stress about it.

As one investor said to me:

“I don’t have time to watch the stock market every day. Managed portfolios help me sleep at night.”

Smart move.

2. Consider a Flexible Retirement Insurance (Fondsgebundene Rentenversicherung)

This is a powerful beginner option.

During the saving phase, your money is invested in the market. When retirement comes, you can choose:

a lifetime monthly pension

a one-time payout

or a mix of both

This flexibility matters when you don’t know what life will look like later.

If better retirement options appear in the future, you are covered by an “Innovationsklausel,” which means you can switch to improved payout types later

191030_highlightblatt_hallo-zuk…

.

That is huge.

A customer once said:

“I like knowing I can get monthly money if I stay in Germany, or take cash if I move home.”

Exactly.

3. Grow Your Savings With Cashback

Yes, really.

The plusrente system lets you earn cashback from normal shopping at more than 1,200 stores. That cashback gets added to your retirement savings and can grow even more over time.

The sheet explains you might earn a percent of your purchase or a fixed euro amount, depending on the shop

191030_highlightblatt_hallo-zuk…

.

One user told me:

“I was shocked that buying shoes online added money to my pension.”

Beginners love this because:

it doesn’t cost extra

it boosts long-term growth

it feels motivating

4. Reduce Risk As Your Life Changes

You may feel brave today. But what about 10 years from now?

Good investment systems allow you to:

move money into safer assets

protect profits

reduce exposure to market swings

This is offered through a Sicherungsoption, letting you shift parts of your fund safely out of risky markets when needed.

A friend once told me:

“I liked growth at first, but when my baby came, I wanted more safety.”

Life happens.

5. Stay Flexible When Life Gets Hard

Immigrant life is not always smooth. Work can change. Family back home may need support. Visas can shift.

That’s why flexibility matters even more.

You can:

pause payments

reduce contributions

switch funds

adjust risk level

withdraw if needed

The product sheet shows many options for “kurzfristige Zahlungsschwierigkeiten” and other life events related to payout and contribution changes.

This keeps your future safe, even during stress.

So, What Should Beginners Invest In?

Here’s the clear answer:

✅ Start with simple, diversified funds.

✅ Use a flexible retirement insurance product.

✅ Boost savings with cashback systems.

✅ Reduce or increase risk as your life changes.

✅ Pause when life gets tough, without losing everything.

You don’t need a big salary.

You need:

time

flexibility

consistency

The earlier you start, the more you gain.

Ready to Take Your First Step?

I created a free 4-step checklist to help you:

choose beginner-friendly funds

compare payout options

avoid hidden fees

build confidence

Just tell me:

“Send me the checklist”

Your future self will thank you.

Get Your Checklist – Free via WhatsApp

The 4 Steps to Financial Freedom for Africans in Germany

Stop dealing with confusing finances. We have compiled the most common mistakes and the most crucial first steps into one super simple checklist.

Don't wait any longer for the perfect moment. The best time to take control of your finances is today. Start with our checklist, which gives you a clear plan immediately.

We will send you the checklist instantly and easily via WhatsApp.

🌱 Dein nächster Schritt

Viele Menschen glauben, nachhaltiges Investieren sei kompliziert. In Wahrheit brauchst du nur die richtigen Schritte – und genau die haben wir für dich zusammengestellt. Lade dir jetzt den kostenlosen 5-Schritte-Ratgeber für nachhaltiges Investment herunter und entdecke, wie dein Geld für dich und die Umwelt arbeiten kann.

© 2025