Health Insurance in Germany for Foreigners: A Simple Guide for African Immigrants

Introduction

Moving to Germany is exciting. The streets are clean, the hospitals are modern, and the system seems safe. But the rules around health insurance can feel confusing, especially when German is not your first language.

Here is the simple truth: health insurance is mandatory in Germany. Without it, you cannot work, study, or feel fully protected. And medical bills can become expensive if something goes wrong.

One newcomer told me:

“My boss said, ‘In Germany, you can’t work without insurance.’ I thought he was joking.”

He wasn’t.

People in Germany are also living longer today. There are already about 600,000 people living over the age of 100. That means you must protect your health and future income early.

Let’s break down how health insurance works for foreigners and how you can build long-term protection for yourself and your family.

1. Public Health Insurance (GKV)

Most workers start with gesetzliche Krankenversicherung (GKV).

It covers:

doctor visits,

hospital care,

checkups,

basic dental work,

mental health.

The price depends on your income, not your health.

It is great for families because children are often covered for free.

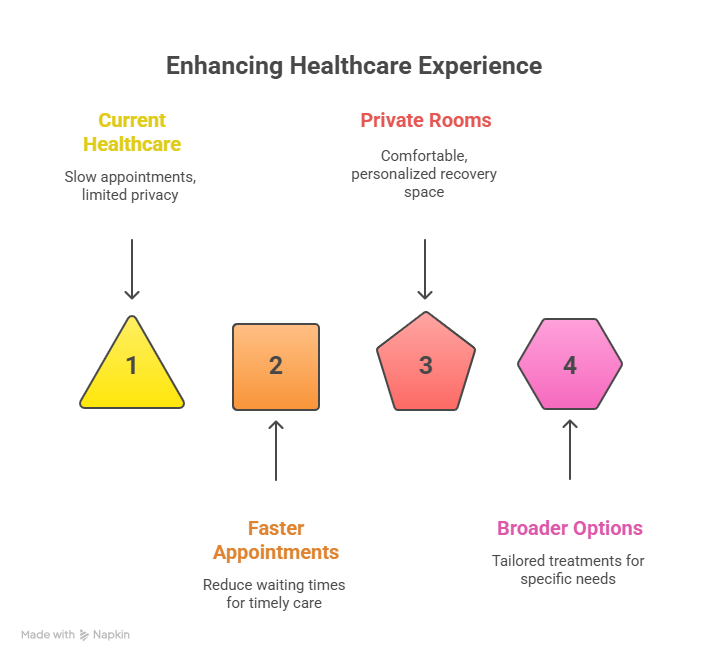

2. Private Health Insurance (PKV)

Some people qualify for private health insurance.

It offers:

faster appointments,

private hospital rooms,

broader treatment options.

The price depends on age and health. It can be cheaper for young, healthy workers or students.

A student told me:

“I got faster appointments with private insurance. It felt like VIP care.”

3. Student Health Insurance

International students can get special reduced rates. It is one of the cheapest ways to be insured in Germany.

Many African students start here because it is affordable.

4. Think Beyond Today: Retirement + Health

When you are older, healthcare becomes more expensive. That’s why many people combine health insurance with a flexible retirement product like a fondsgebundene Rentenversicherung.

You can choose:

✅ a lifetime monthly pension,

✅ a lump-sum payment,

✅ or a mix of both

This helps pay medical bills when you are no longer working.

A woman told me:

“Old age scares me. I want money every month so I can see a doctor when I need to.”

5. Adjust Risk as Life Changes

When we are young, growth feels exciting. But later, we want safety.

With the Sicherungsoption, you can shift parts of your investment into safer holdings without tax problems. That protects your money from big market drops.

Life changes. Your risk should too.

Why This Matters for You

As an immigrant, you don’t have family property, government support, or a safety net here. Without insurance, one accident can destroy years of progress.

Health insurance gives:

✅ peace of mind,

✅ security,

✅ access to care,

✅ and protection for your family.

So, How Does Health Insurance Work for Foreigners?

Here’s the clear answer:

It is mandatory.

It protects you from huge medical bills.

You can choose public or private plans.

Students get reduced rates.

When life gets hard, you can pause contributions.

For old age, combine with flexible retirement protection.

Think of it like armor. You don’t feel it every day… but when life hits you, you’re glad you have it.

Get Your Checklist – Free via WhatsApp

The 4 Steps to Financial Freedom for Africans in Germany

Stop dealing with confusing finances. We have compiled the most common mistakes and the most crucial first steps into one super simple checklist.

Don't wait any longer for the perfect moment. The best time to take control of your finances is today. Start with our checklist, which gives you a clear plan immediately.

We will send you the checklist instantly and easily via WhatsApp.

🌱 Dein nächster Schritt

Viele Menschen glauben, nachhaltiges Investieren sei kompliziert. In Wahrheit brauchst du nur die richtigen Schritte – und genau die haben wir für dich zusammengestellt. Lade dir jetzt den kostenlosen 5-Schritte-Ratgeber für nachhaltiges Investment herunter und entdecke, wie dein Geld für dich und die Umwelt arbeiten kann.

© 2025